Mindfull Money: Financial Literacy Gamified

A mobile app that encourages financial literacy through gamification, and community.

Overview

Mindful Money is an app that gamifies financial literacy. It allows users to play games focused on 4 core financial literacy topics which engage and increase financial literacy. The user can compare scores and compete against friends to increase engagement and build community with access to short articles and videos that help reinforce learnings.

I chose this project topic because having worked in the finance industry for a couple of years, coming from a completely different background, I recognized how much I really didn’t know and how much of it I wasn’t taught. Overtime I realized that many are disadvantaged and aren’t privy to “common” information and it essentially leaves them financially crippled and illiterate.

Problem

The gap of financial literacy is wide. While there are many free resources available. It still may be intimidating and overwhelming to figure out where to start. Many have a disadvantage because they aren’t exposed to core financial concepts and resources and often have to teach themselves through trial and error.

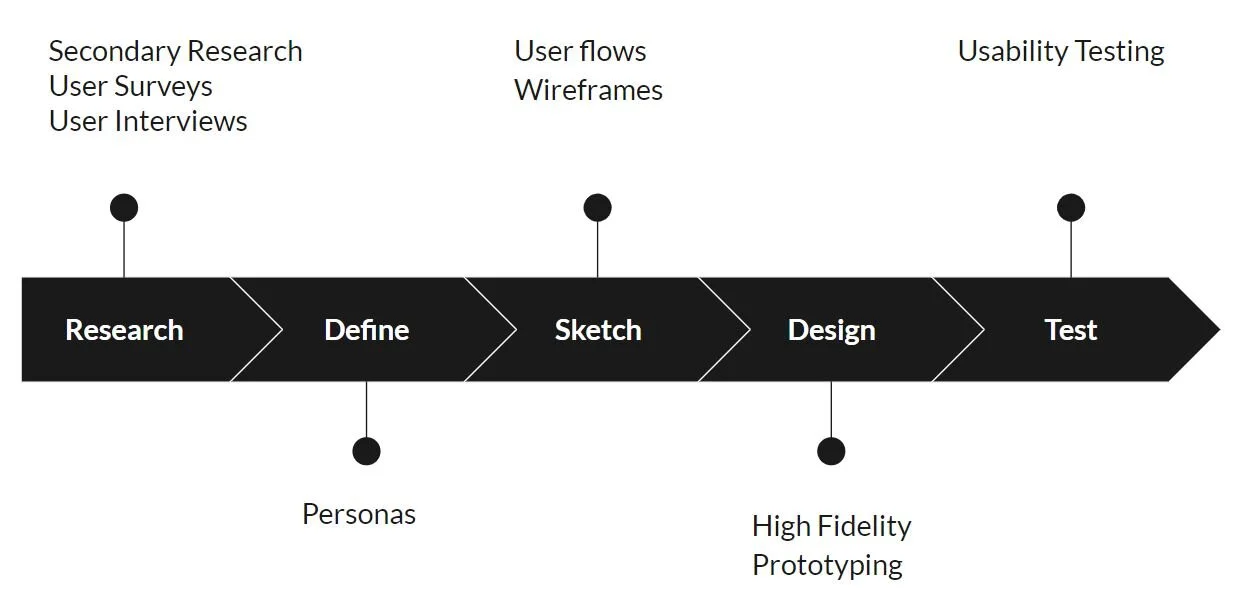

Tasks & Duration

User Surveys, User Research, Usability Testing, Sketches and Wireframes, Prototyping

4 Months

HOW MIGHT WE curate financial topics to engage and empower people that have been at a disadvantage, to take charge of their financial literacy by gamifying core topics?

Development Process

Secondary Research

Financial Literacy Education

Generally the younger you are the less financially literate you are, but African Americans in each age group tend to have lower financial literacy than their white peers. Financial literacy is correlated to formal education and socioeconomic class, but even when taken several factors into consideration, there is still a large difference in financial literacy amongst whites vs. blacks. Financial literacy is closely associated with financial wellness.

The research examining the returns to financial literacy education finds that there are different returns by race, and most of the differences exist for college level education only. It was found that parental financial literacy education helps increase overall financial literacy. There is evidence to show that parental financial literacy education depreciates faster for minorities than for white people, and white people are more likely to be influenced by parental education as they age.

Overall, financial education was monitored formally and informally, and showed that more white people had access to formal and informal financial education and the financial education that seemed to be highly influential was parental education.

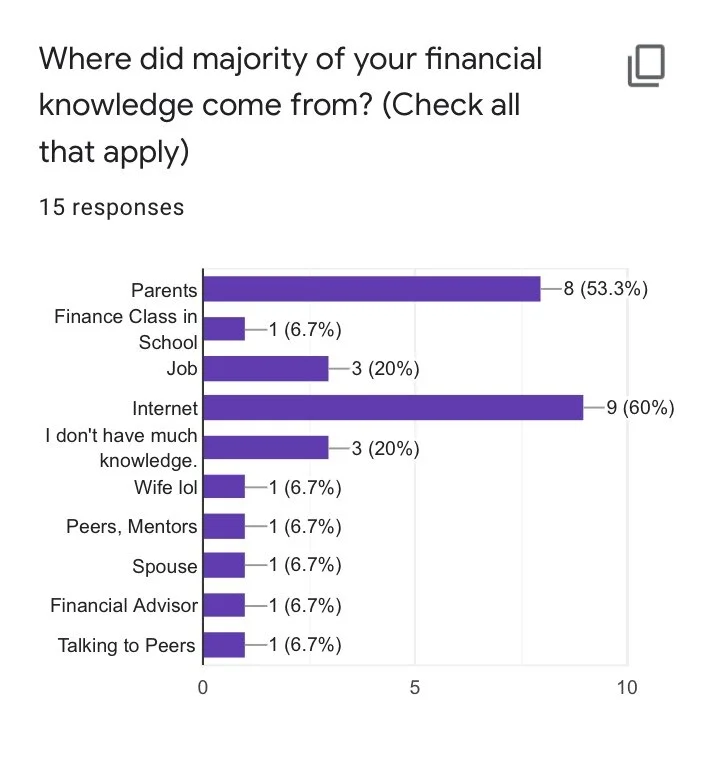

User Surveys

15 Responses

Ages 18-29

Objectives:

Determine which users I would gain the best and most diverse insight from in a user interview

Gain insight on financial sources

Gain insight on which financial topics users don’t feel comfortable with

Insight into the level of confidence in financial literacy.

Insights from the Survey

53.3% and 60% respectively, of users credited parents and the internet for the source of majority of financial knowledge.

Interest rates and money flow and asset creation are the least knowledgeable topics.

93.3% of users were actively trying to gain financial knowledge.

Interviews

5 User Interviews

Objectives:

Identify an ideal user persona

Insights:

Users without a financial foundation at younger ages, lack financial confidence and empowerment,

Users in underserved communities aren’t aware of the resources available.

The internet is an excellent place to learn financial topics, as long as they are filtered and reliable

Quotes from the Interviews

“You don’t know what you don’t know”

“I still don't know how to balance a checkbook”

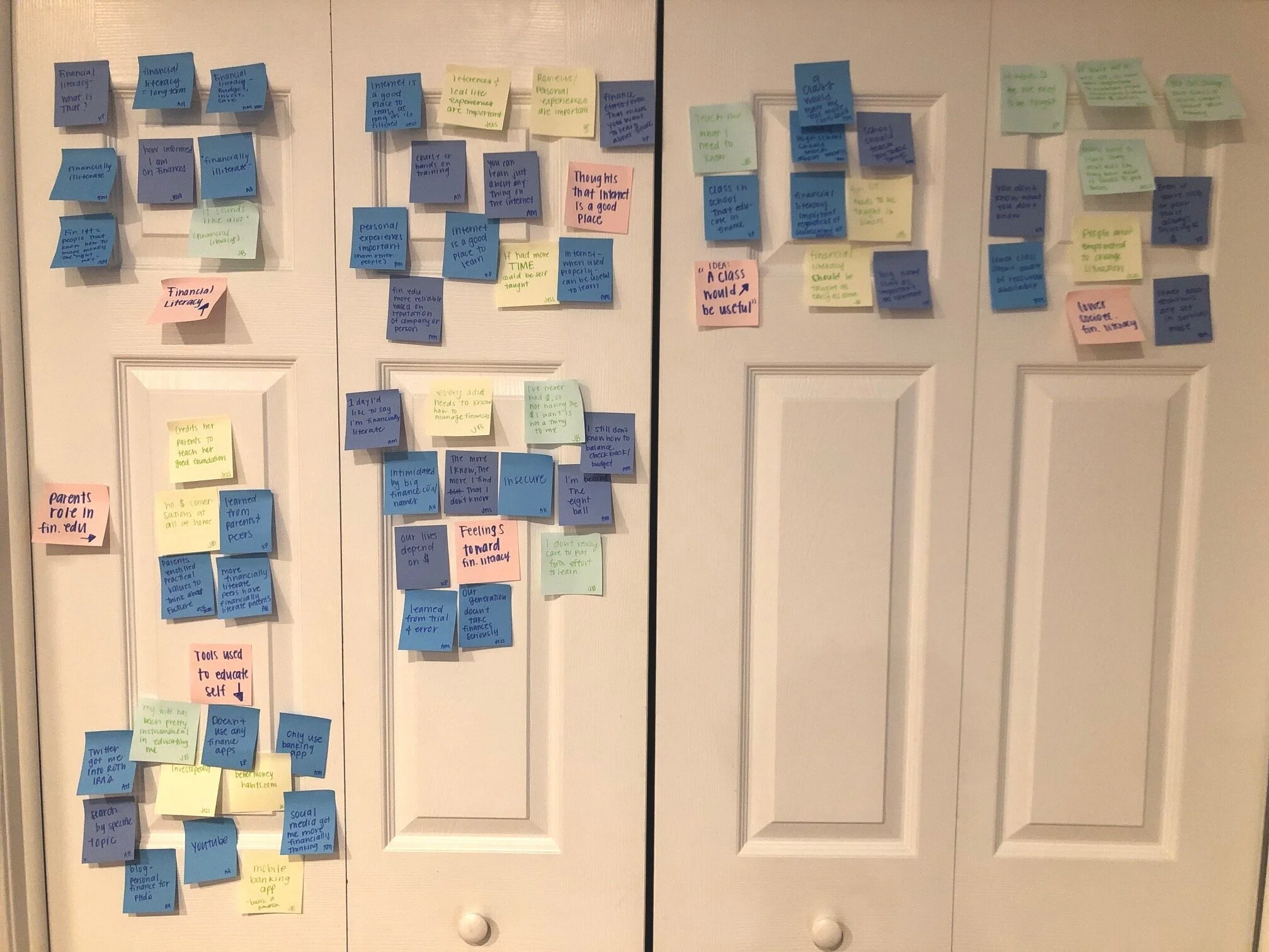

Affinization of Data

Initial grouping of quotes, thoughts and ideas from all interview participants.

Final grouping of relevant quotes, thoughts and ideas of participants central topics.

Key consensus from interview participants:

Financial literacy is closely related to your parents’ financial literacy. Many participants felt like their foundation was from their parents.

All participants use the internet to educate themselves on a wide range of financial topics, from social media to Investopedia.

All participants feel insecure about their level of financial literacy to some degree.

All participants think a classroom like setting would be very beneficial to learn from.

Defining the Target Audience

The primary target audience included people between the ages of 18-29. 3 types of users emerged from the users surveys and interviews. From our surveys & interviews, I learned that majority of the users had a desire to gain financial knowledge, but they took varying levels of effort to gain that knowledge.

Of the three types of users, two were taking a more active approach to taking charge of their own financial literacy. And of the two, the user I decided to focus on was a user that represented a 18-27 year old, educated user that wants to increase their knowledge, but due to a lack of financial literacy from a young age, they have low confidence. Especially due to their possible earning potential, they are especially in need of, and motivated to increase their financial knowledge.

Design Decisions

Designing User Wire Flows

Onboarding Wire flow

App Function wire flow

Wireframe to High Fidelity

Wireframes

High Fidelity

Usability Testing

Issues from user testing prioritized from critical to normal.

I tested users at various levels of the design process. All rounds of testing were with 5 different sets of users.

Sketches were used for usability testing to receive feedback on the onboarding flow and how it translated to users. I also wanted feedback on the game flow.

High- fi testing was conducted. All users were asked to complete hypothetical tasks.

Core Game Topics

I chose to focus on 4 core topics to break down the information into digestible information in order to appeal to the users' need for the basics and reinforces concepts with short articles.

Personalized Onboarding

Onboard members with a short quiz to personalize their gaming experience and provide statistics around their own information and game statistics.

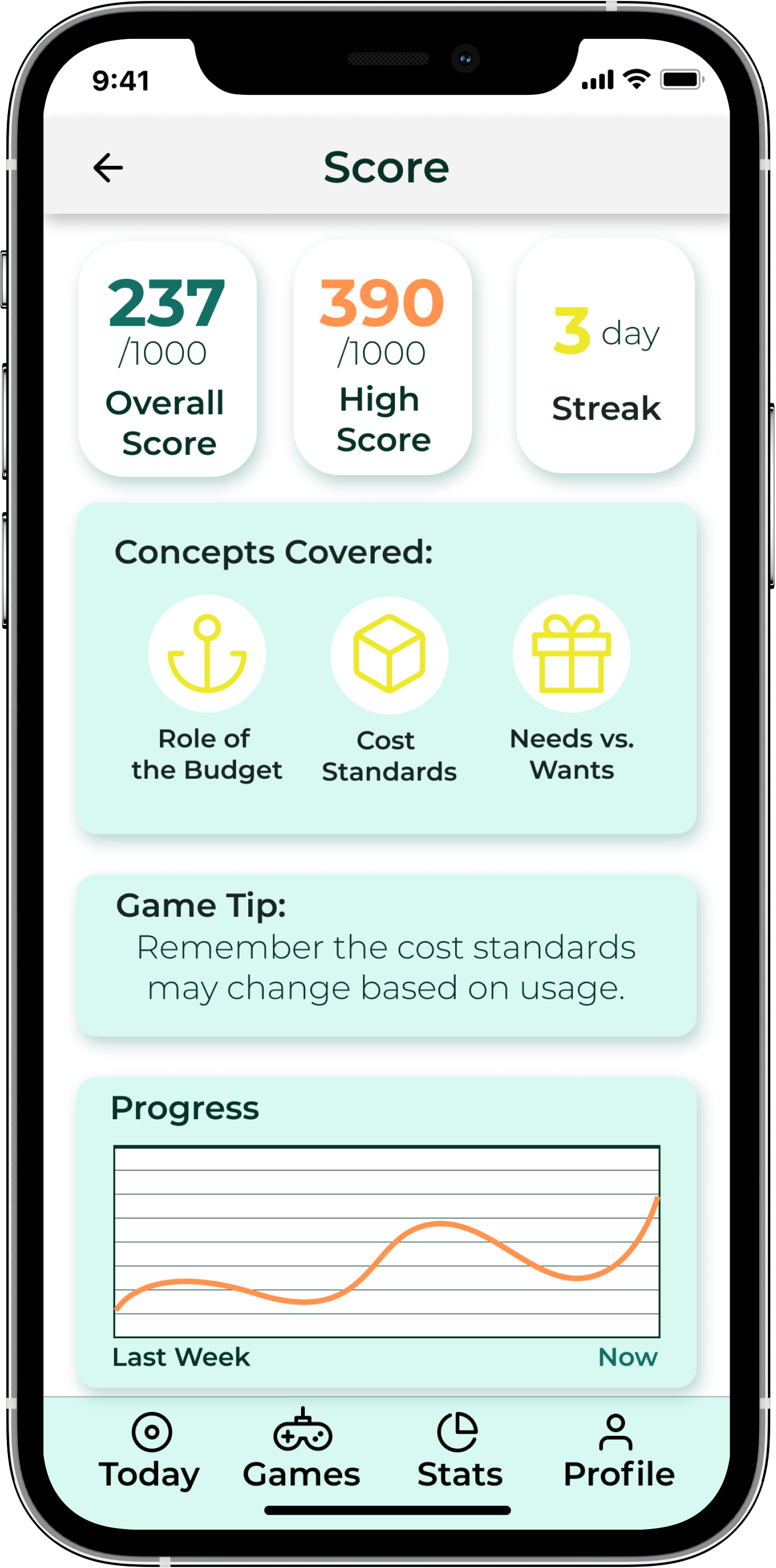

Scoring

Highlights users growth by reporting streaks and progress from previous scores on scoring page. Allows you to compare with others in your age range.

Build Community through Competition

In order to build community, Mindfull Money allows to you to connect with friends on other platforms and encourage others to increase their financial literacy through competition.

Project Learnings

Keep it simple. This was my very first UX project and I learned that when you keep it simple, it translates to the audience much better. From colors to the amount of details shown within a screen.

Seek feedback early and throughout the process. Keeping users in loop and testing usability in whatever form (paper, low-fi or hi-fi) as early as possible, saves so much time and re-work.

Don’t get caught up on the UI early on. UI can eat up a lot of time early on in the process, especially if done before usability testing is conducted. The UX is the most important part in the low-fidelity stages, and UI can be more focused on in the hi-fidelity stages.